Mexico: The New Competitor to China in the Lithium Sector?

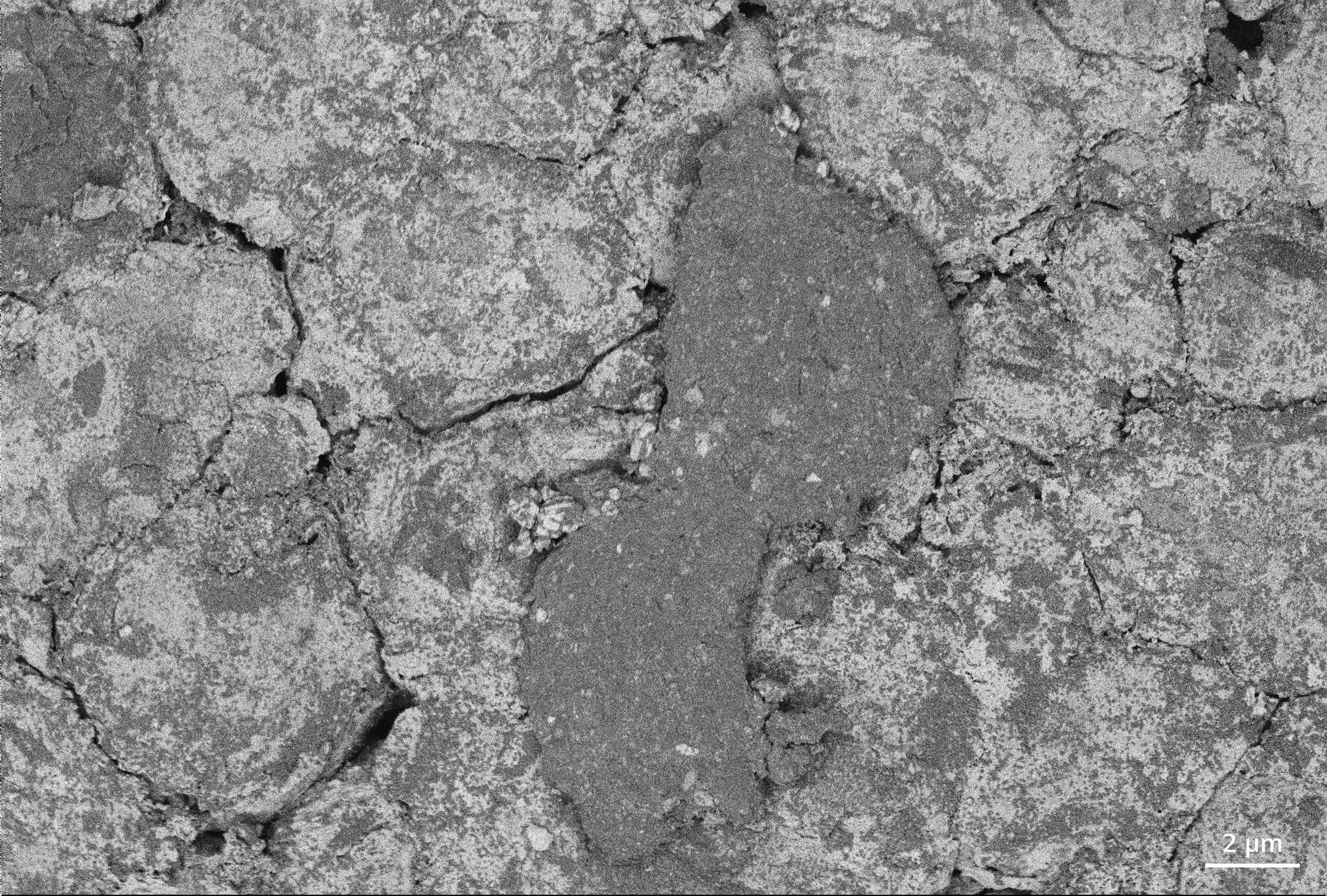

Photo: ZEISS Microscopy.

According to a report by Gizmodo, Mexico would have an advantage in becoming a benchmark in the lithium market in Latin America and worldwide due to its large reserves. However, it faces challenges in infrastructure and environmental regulations.

Currently, in Sonora, Mexico has one of the largest and most important lithium deposits in Latin America, known as the Lithium Valley, which holds more than 243 tons of this mineral. This resource is expected to drive the full development of the mining industry in the country.

Nowadays, countries like the United States and the People’s Republic of China are seeking to secure their lithium supply, and Mexico could become one of the main suppliers of this resource. It is worth mentioning that lithium is essential for the global energy transition, whose demand has increased due to the growth of markets such as clean technologies and electric vehicles.

However, the Mexican government recently canceled concessions granted to the Chinese company Ganfeng Lithium due to non-compliance with the agreed investment goals. This decision represented an attempt by the Mexican government to regain control over its natural resources, but it also created uncertainty about how the exploitation of this deposit will be managed in the coming years.

In recent times, without a doubt, the People’s Republic of China has been the leader in the lithium sector, holding much of the processing and battery production. However, some Latin American countries, mainly Mexico, have discovered new reserves that could be key to challenging the Asian country’s dominance.

With these discoveries, Mexico could develop a highly competitive lithium industry, positioning itself as a regional benchmark and a key global supplier. If this happens, the country could rank among the top in global energy and battery supply, boosting its economy through a high-value-added industry.

Nevertheless, this will not happen if the country fails to develop a strategy that strengthens the local lithium sector, attracts investment in infrastructure, and does not solely benefit foreign companies.

On the other hand, it is important to highlight that although lithium could strengthen the Mexican economy, its production entails risks, such as environmental and social challenges. For example, lithium mining in Sonora requires large volumes of water for its development, and this region is currently facing severe water scarcity. Likewise, the extraction of this mineral involves the use of various chemicals that affect the local ecosystem.

Furthermore, the economic benefits generated by lithium production are not always reflected in the daily lives of communities near the deposits. In several Latin American countries where lithium mining is already underway, there have been negative impacts on the land, leading to protests and social conflicts. In this regard, Mexico is expected to learn from these experiences and develop a sustainable model that guarantees environmental protection and the rights of communities near the deposits.

Last but not least, Mexico is expected to optimally manage its lithium resources to establish itself as a leading producer of this mineral and position itself as one of the top players in the sector. To achieve this, it is crucial that its decisions are strategic, favoring local producers rather than exclusively benefiting foreign companies that would boost overseas economies. The country’s decisions will be decisive not only for the development of the lithium sector in Mexico but also on a global scale.

Main Source:

Related News:

Chinese company Ganfeng sues Mexico for revoking lithium concessions

You may be interested in:

Oportunidad de litio en México se aleja por falta de inversión, tecnología y disputas legales – Bloomberg Línea

China y México: entre la espada comercial y la pared geopolítica – Observatorio de la Política China